Tax Preparation for Military Families in San Antonio, Texas

Minimize taxes

Audits and tax court matters are included. You can either sit on your couch or pull up a seat in our office. Finding someone who you can trust is important, whether your taxes are complex or straightforward. We will prepare and file all your taxes correctly on time, so you won't have to worry about it. How do you become an accountant?

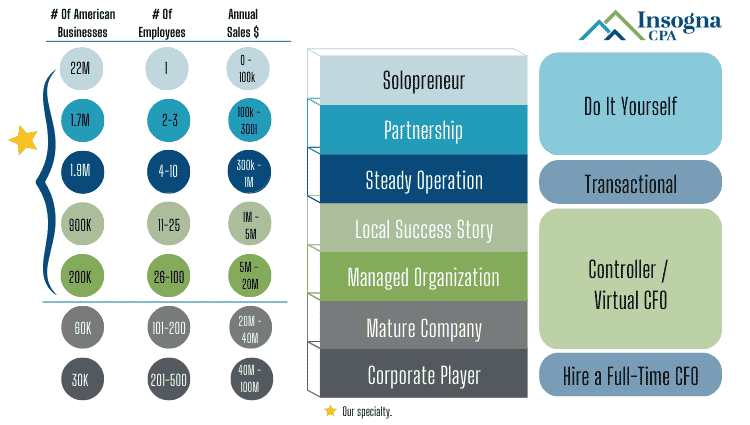

We can help you keep your books accurate, whether you are self-employed or run a small business. Every year, our professionals help millions of owners of small businesses with their taxes. With confidence, form your LLC or corporation. The professional services of a certified public accounting firm are tailored to each client's specific business and financial requirements.

IRS Free File allows individuals, regardless of their income, to request an automatic extension for tax filing electronically. This tax is levied on certain entities that do business in Texas. You can either hire a professional to do your taxes, or you can file them yourself with the help of an expert. Every year, our professionals help millions of small business owners with their taxes.

We will also prepare your return to ensure that it is accurate and complete. They can also resolve any issues that may arise. Stay on top of the latest laws and protect yourself from being audited: Corporate Transparency act and reasonable compensationInsogna is the best choice for all of your S-Corporation Tax Preparation needs. Contact us to find out more about what we can do for you!