Reduce Taxes on Your Investments with Help from San Antonio CPAs

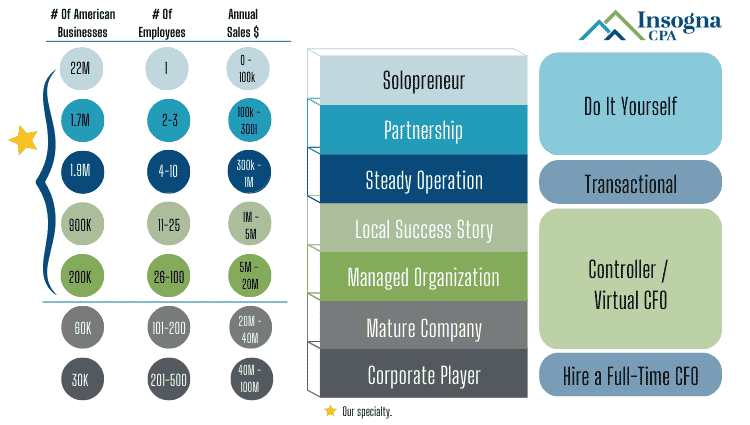

business income

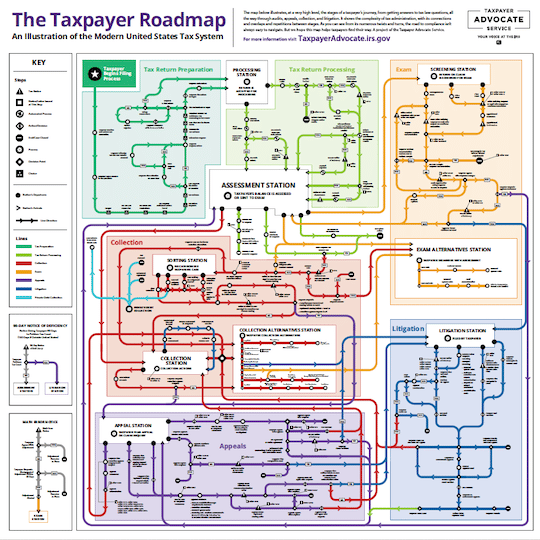

We will assist you in planning, preparing and filing your taxes, whether you're an individual or small business. CPA firms can provide advice on tax planning and help businesses and individuals understand their tax obligations. Tax preparers must serve both their clients and the IRS. This will allow you to focus on the next step. Learn more about IRS Free File, including how to start, security and protection, forms available, and other information.

The extent of what tax preparers can do depends on their credentials, and whether or not they have representation rights. Tax preparation can be a time-consuming process and even a pain. Our tax experts are available to answer your questions and discuss the progress of filing your return. You can get more or fewer details from your return depending on the type you order.

Our team at Molen & Associates is here to help if you aren't sure which entity is best for your business.

Reduce Taxes on Your Investments with Help from San Antonio CPAs - Tax penalty relief

- Startup tax planning

- Tax preparation professionals

- Compilation services